Every quarter, the NBU prepares its economic forecast and publishes it in the Inflation Report. The report contains a lot of useful information, but is primarily intended for professionals. This webpage was created to make it easier for anyone to learn about major economic events and the NBU’s vision of the future development of the Ukrainian economy.

How is the economy holding up?

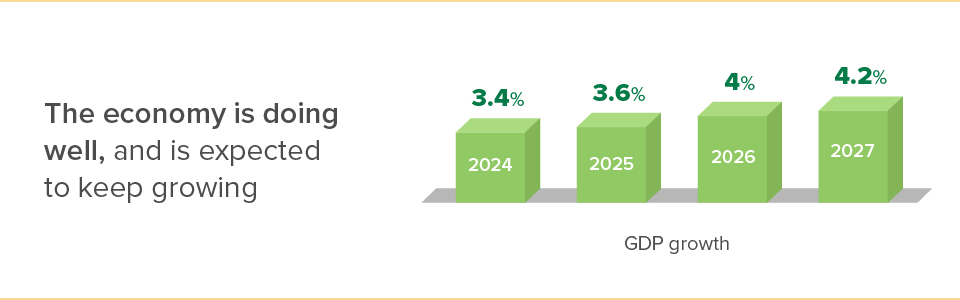

Last year, the economic recovery continued, although it slowed down due to the difficult situation at the frontline, an increase in russia’s air attacks and related electricity shortages, and lower harvests. According to the NBU’s estimates, Ukraine’s real GDP grew by 3.4% in 2024. This result was achieved thanks to the endurance of the Armed Forces of Ukraine, the resilience of businesses and households, continued significant international support, and the government’s measures to rebuild infrastructure and ensure social protection.

The main factors that continue to restrain the economic growth are the consequences of the war: the destruction of critical infrastructure and production facilities, as well as the lack of employees at enterprises due to migration and mobilization. Despite these challenges, the NBU expects the economy to grow by about 4% annually in 2025–2027. Further recovery will be driven by both the expected increase in harvests and larger investment in Ukraine’s reconstruction – including from private businesses and foreign investors.

International support will remain an important pillar of Ukraine’s recovery. Currently, Ukraine is expected to receive more than USD 38 billion in external financing in 2025 and USD 25 billion next year. However, these amounts could be much higher if immobilized russian assets are transferred to Ukraine. A strong boost to the Ukrainian economy could also come from accelerated European integration. As Ukraine moves closer to joining the EU, international business will become more interested in our country.

What will happen to jobs and wages?

The situation on the labor market remains quite tense due to the lack of workers. The reason for this is the migration and mobilization processes caused by the war. Although the number of resumes on job search websites has increased, the lack of workers – according to surveys held among businesses – is still a major obstacle to companies’ operations.

Quite often, companies also face the issue where candidates respond to the job openings, but their competencies do not meet the required level. Meanwhile, in areas close to the war zone, another problem is that it is harder to find job openings. Therefore, the unemployment rate is uneven across regions and is much higher in the frontline areas. Naturally, this situation also has a negative effect for the economy.

At the same time, high competition among businesses for workers stimulates further wage growth. Thus, already at the end of last year, real wages in enterprises across various sectors were mostly higher than before the full-scale war. Wage growth is outpacing inflation, which means that they more than compensate for the increase in prices for goods and services. The NBU expects real wages will also grow by 3%–4% per year in 2025–2027.

What about prices?

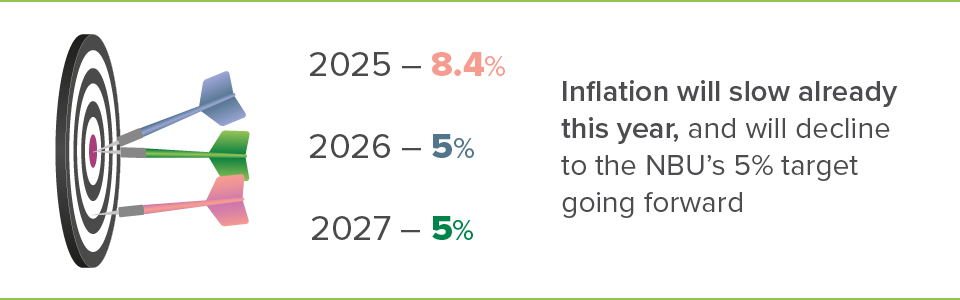

Consumer prices increased by 12% last year. The main reason for the increase in inflationary pressure was higher food prices due to lower harvests. The war, of course, had an impact on prices as well. In particular, russia’s attacks on the energy infrastructure increased businesses’ expenses on electricity. In addition, mobilization processes led to businesses incurring higher recruitment and wage costs. Prices were also affected by a weakening of the hryvnia exchange rate.

Prices for various goods and services changed in different ways. For example, vegetable prices rose the most, while prices for flour, cereals, dairy products, and some fruits increased significantly. Cigarette prices also grew markedly due to a further hikes in excise taxes. At the same time, tariffs for heating, gas, and hot water supplies remained unchanged. Prices for clothing and footwear also did not change significantly and were sometimes even lower than a year ago.

High inflation will not last long and will begin to slow in the summer. The expected increase in harvests will help curb the rise in food prices. For its part, the NBU will maintain the sustainability of the FX market and protect hryvnia savings from inflation. All of this will help to reverse inflation toward a sustainable slowdown. The NBU expects inflation to decline to 8.4% in 2025 and to the 5% target in 2026.

How can savings be protected from inflation?

To prevent inflation from eroding hryvnia savings, the NBU raised its key policy rate to 14.5%. This stopped the deposit rates from falling. Some banks even raised their rates on retail term deposits. Currently, many banks offer 15% or more per annum (about 12% after tax) for placing deposits. Domestic government debt securities – which can be purchased through the apps of banks and brokers – yield 15%–16%, with income from these securities not being subject to tax.

The NBU has also been maintaining the sustainability of the FX market. In recent months, the hryvnia exchange rate has fluctuated slightly in both directions, weakening and strengthening.

The FX market is facing a deficit in the fallout from the war. The deficit is being covered from international reserves, which, in turn, are being replenished from partners’ assistance. In periods when such deficit narrows, the hryvnia strengthens, and vice versa.

Thanks to external assistance, the NBU has a record-high level of international reserves (almost USD 44 billion at the start of the year). The central bank thus remains fully capable of continuing to maintain a sustainable situation in the FX market.

All of this has supported confidence in the hryvnia. Ukrainians continue to invest in hryvnia term bank deposits and help finance the state budget by investing in government bonds. Given the expected slowdown in inflation in 2025, the current yields on bank deposits and domestic government debt securities should provide sufficient protection for hryvnia savings prom inflation.