Why did the NBU move to more exchange rate flexibility? Why is the regulator gradually relaxing the FX restrictions?

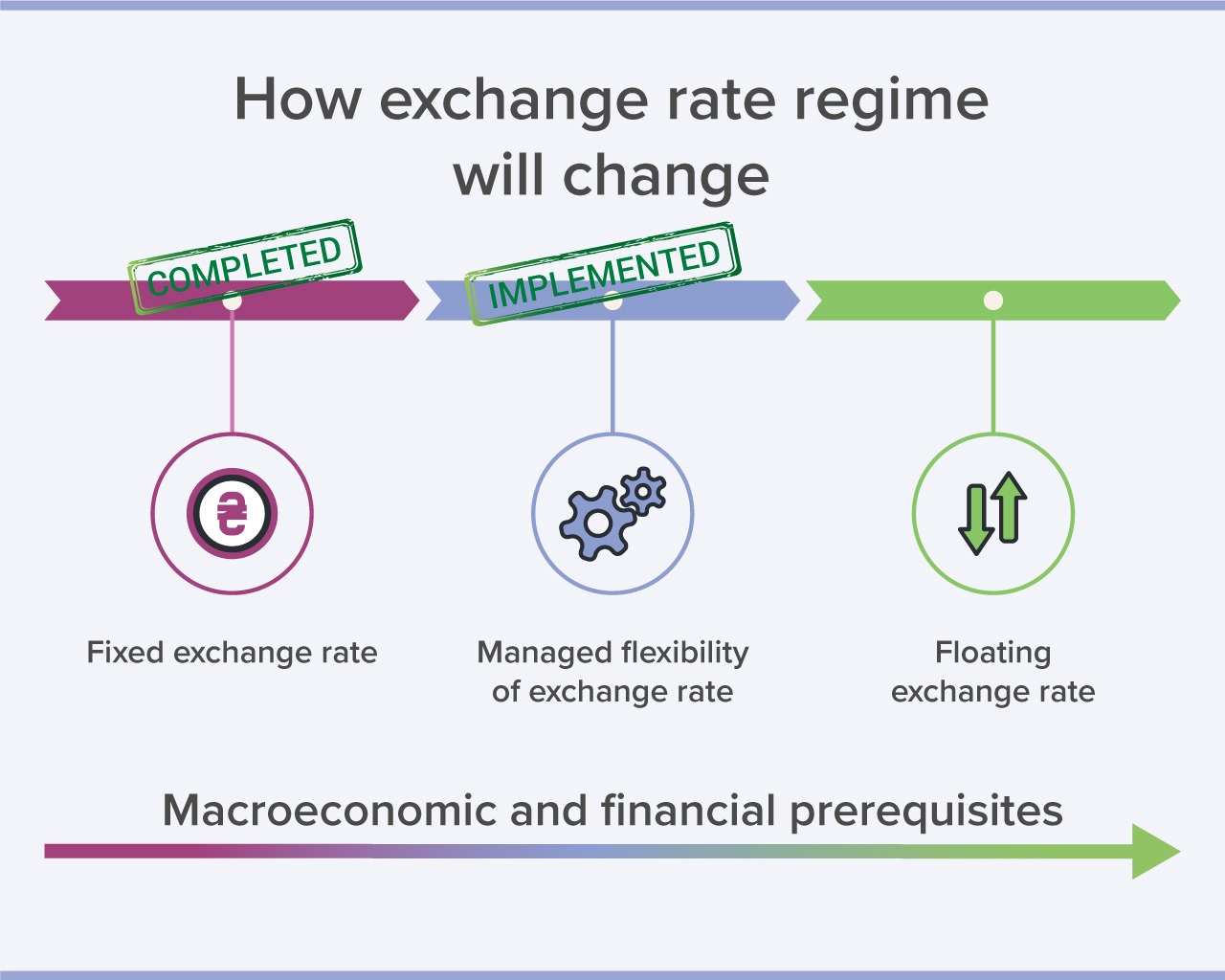

The NBU was forced to fix the official exchange rate and introduce strict FX restrictions on 24 February 2022. The central bank was consistently emphasizing that these decisions were temporary and justified.

These decisions made it possible to prevent panic and ensure the stable operation of the financial system. They helped businesses and households adjust to the full-scale war. However, the fixed-exchange-rate regime and FX restrictions come with both benefits and costs, and over time, the costs begin to outweigh the benefits.

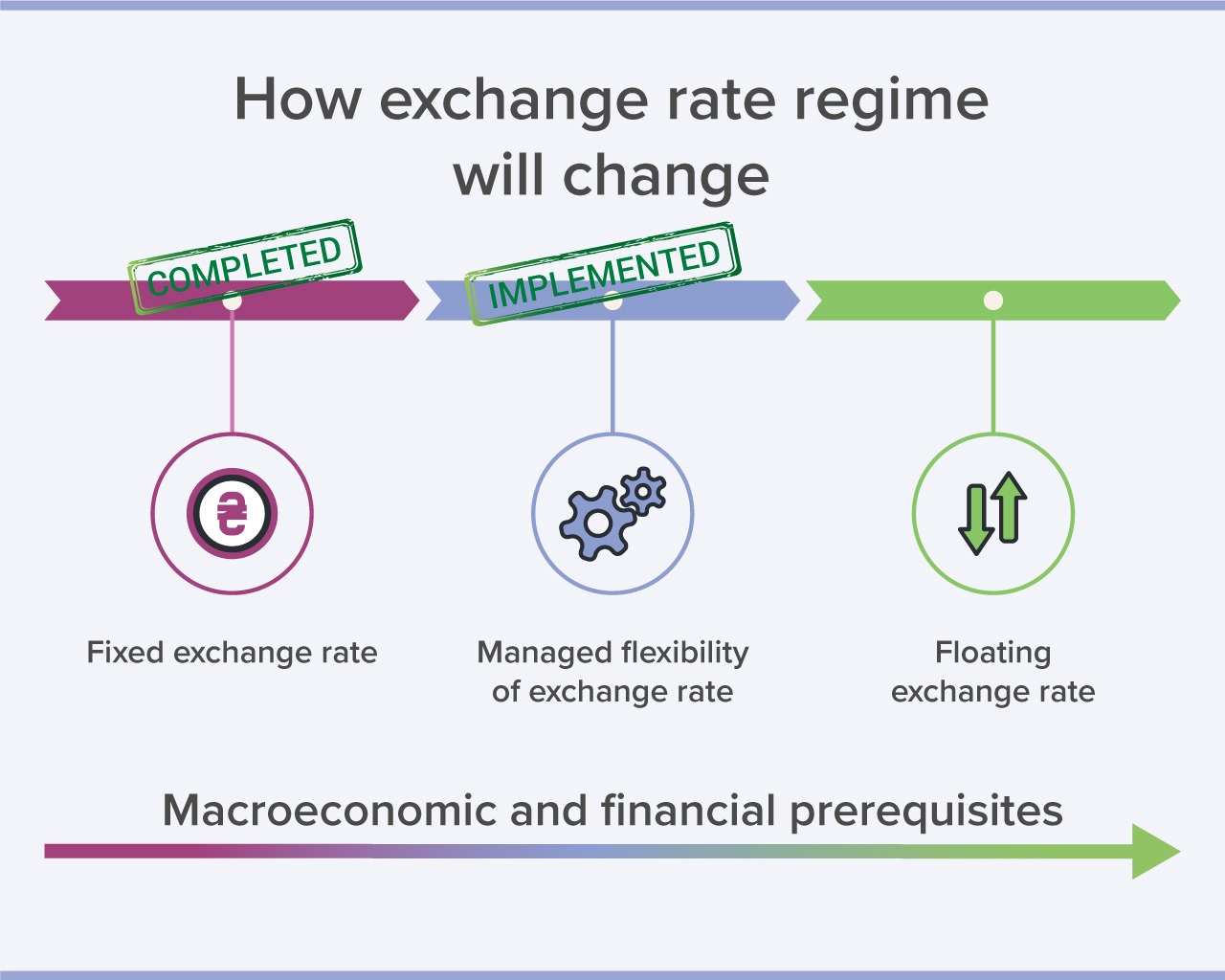

Most Ukrainians remember well the currency crises of 2008 and 2014–2015, when the domestic currency depreciated significantly. The depth of these crises was substantially aggravated by the yearslong exchange rate peg. Keeping the exchange rate at the same level for many years usually results in the accumulation of FX imbalances, the depletion of international reserves, a forced deep devaluation, and a significant economic downturn. This is precisely why most countries do not use fixed-exchange-rate regimes and tight restrictions, and why the NBU switched to managed flexibility of the exchange rate in October 2023 and is planning to continue to ease the FX restrictions.

Ukraine had already had a positive experience operating a floating exchange rate. Specifically, the NBU had transitioned to such an exchange rate regime after the 2014–2015 crisis. In the following years and up until the full-scale invasion, the hryvnia’s exchange rate fluctuated in both directions, weakening and strengthening in line with market developments. The NBU only smoothed out excessive exchange-rate fluctuations by selling or buying foreign currency in the market. Those interventions neither counteracted nor fortified the underlying exchange rate developments.

Thanks to such flexibility, Ukraine did not accumulate FX imbalances and no longer experienced FX crises. Despite some fluctuations, the exchange rate remained relatively stable throughout the entire floating-exchange-rate period. In addition, the NBU steadily accumulated international reserves during that time.

The October 2023 shift to a more flexible exchange rate has also helped reinforce the economy’s and the FX market’s resilience against external and domestic changes.

Does it mean the NBU has returned to the same floating-exchange-rate regime as before?

No. At first, the NBU moved to managed flexibility of the exchange rate. This is due to the specifics of how the economy is functioning amid the full-scale war.

Because the country’s export capabilities and investment inflows have been restrained by the war, the FX market is constantly experiencing a significant shortage of foreign currency. In view of this, it is too early to return to a floating exchange rate whereby the NBU would only have to reduce excessive fluctuations in the market.

NBU instead uses managed flexibility of the exchange rate to cover the market’s structural shortage of foreign currency. This will allow the hryvnia to both weaken (when the shortage widens) and strengthen (when it shrinks). In addition, the NBU smooths out excessive exchange-rate fluctuations.

The NBU’s FX sales will therefore help maintain the sustainability of the FX market, while sufficiently high interest rates on hryvnia deposits will protect savings from inflation (more on this below).

Should we expect the hryvnia to weaken sharply while under managed flexibility of the exchange rate?

People often associate the NBU’s exchange rate policy decisions with the hryvnia’s sharp depreciation. This is due to Ukraine’s bitter experience whereby the NBU was forced to let the hryvnia float due to the depletion of international reserves and the inability to maintain a fixed exchange rate.

But now the situation is different. Exactly why is that?

First of all, in previous years, the NBU:

- gained considerable experience in smoothing out exchange rate fluctuations

- accumulated a record-high level of international reserves

- increased the attractiveness of the hryvnia as a store of value.

Second, the NBU made thorough preparations for the transition to managed flexibility of the exchange rate. The central bank took this step after the macroeconomic and financial prerequisites had been met. And so the transition was a controlled one.

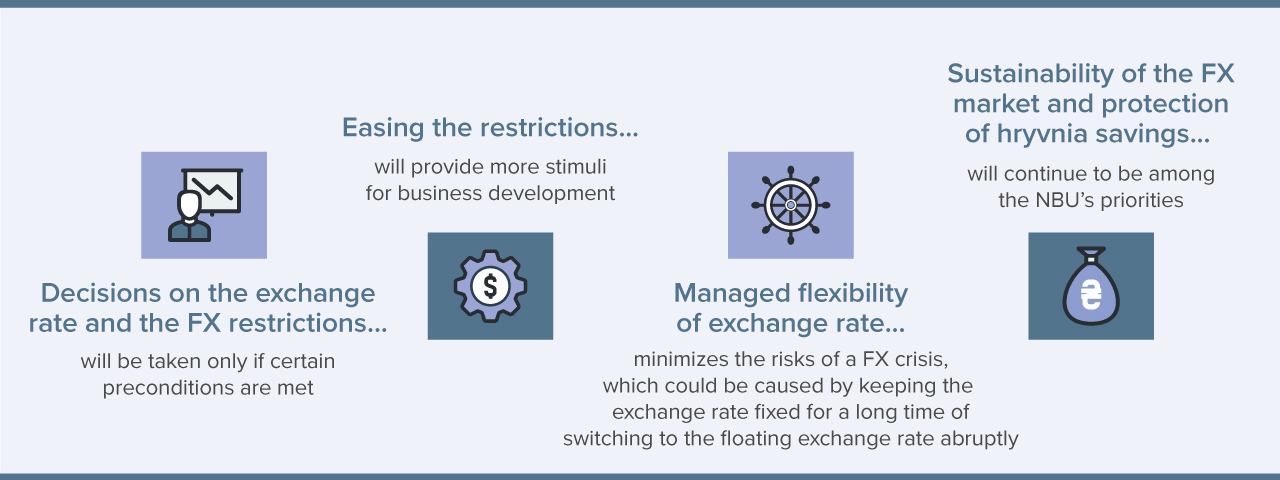

Third, the transition to managed flexibility of the exchange rate does not mean that the NBU allowed the exchange rate to float free. The NBU maintains its presence in the market and makes up for the structural deficit of foreign currency. This is precisely what ensures that the hryvnia can both weaken and strengthen. For its part, greater flexibility of the exchange rate reinforces the FX market’s sustainability and the economy’s resilience to domestic and external shocks.

Maintaining the FX market’s sustainability remains one of the NBU’s priorities. This means facilitating the kind of exchange rate developments that make it possible to slow inflation into the single digits in 2025 and bring it down to the NBU’s target of 5% in the following years. . The FX market’s sustainability is also about the absence of dangerously sharp exchange rate fluctuations. A complete lack of exchange rate volatility, however, means that the exchange rate is pegged rather than sustainable. The NBU has deliberately abandoned the exchange rate peg because of the totality of adverse effects it tends to generate.

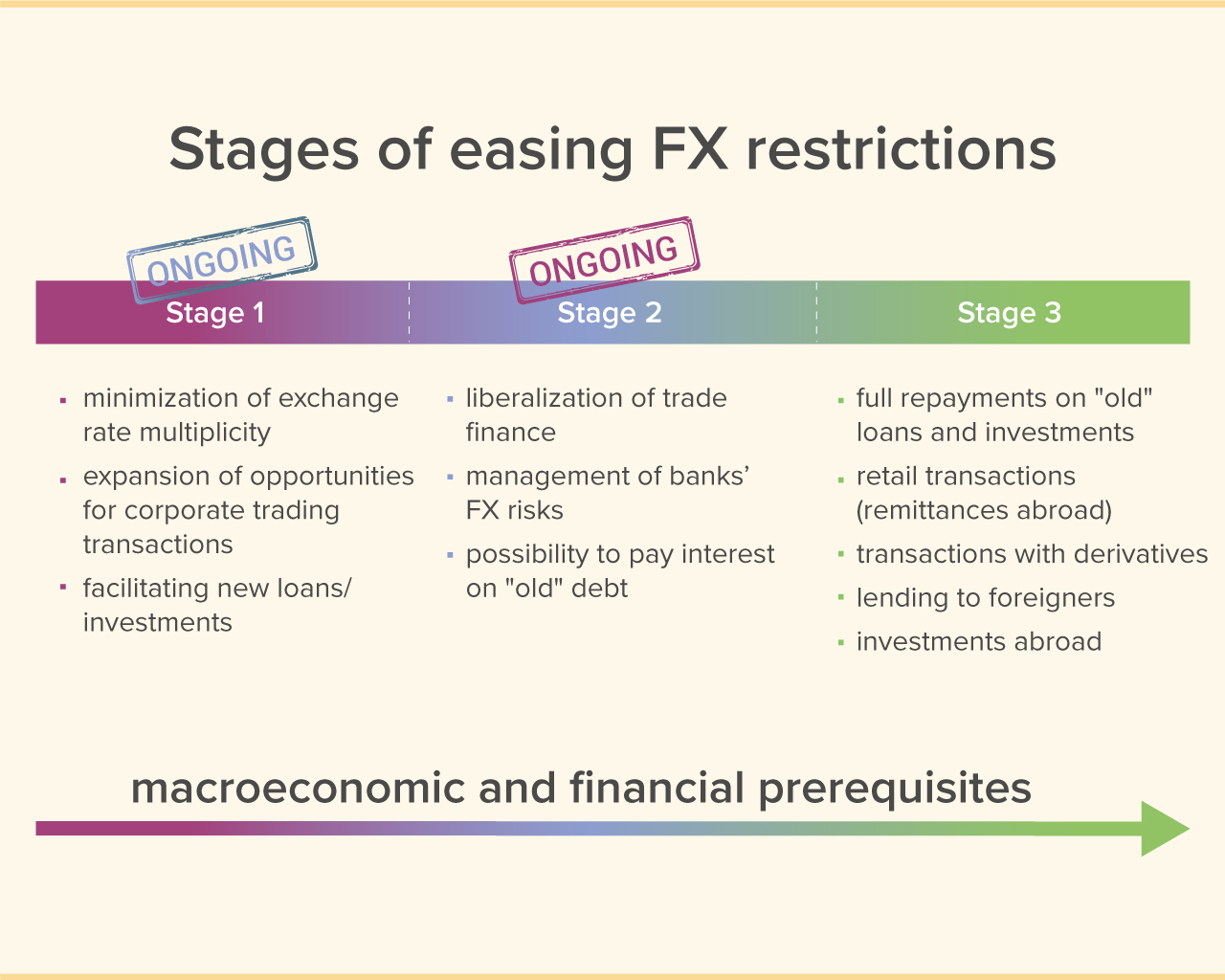

Which FX restrictions will the NBU ease first?

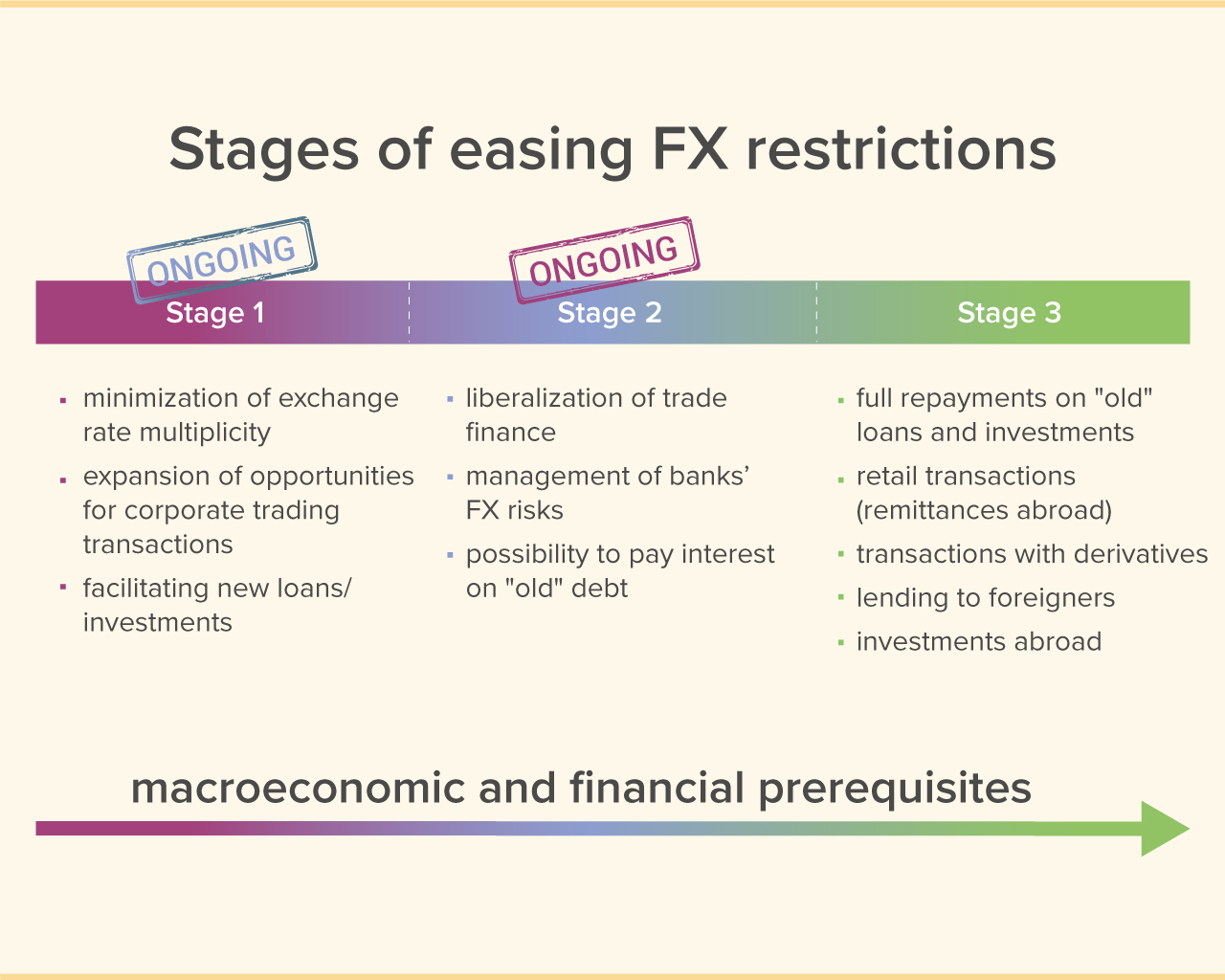

The strategy envisages that this process will take three stages to complete.

Most first-stage measures have been completed. Specifically, the NBU has eliminated the multiplicity of exchange rates: the difference between the official and cash rates has largely remained within 1% for more than a year now.

Possibilities for trading transactions by businesses have been expanded. As early as mid-2022, businesses were allowed to pay for any merchandise delivered from abroad, and in May 2024, for imports of works and services. The only condition for making such transactions is that the delivery of goods, the receipt of works, and the provision of services take place after 23 February 2021 (except in certain cases).

In addition, the NBU relaxed a number of restrictions to facilitate investment inflows into Ukraine. So, businesses were given the opportunity to repay "new" foreign loans and partially transfer abroad "new" dividends . However, some of the transactions are subject to limits. The implementation of stage one is therefore still underway.

In parallel, the NBU in May 2024 began to implement the second stage of the loosening of restrictions, as the necessary prerequisites had been put in place. In particular, the regulator enabled businesses to partially service "old" external loans and repay "new" loans, as well as transfer funds abroad under leasing and rental agreements.

Overall, the NBU’s plan for the second stage of loosening the FX restrictions includes:

- liberalizing trade finance

- unlocking more opportunities for banks to manage FX risks

- removing the caps on interest payments on "old" external loans, meaning the loans not covered by stage one. As far as principal amounts of debt are concerned, it will be possible to repay or transfer them only at stage three.

In May 2025, the NBU launched a stimulating FX liberalization whereby measures that relax FX restrictions come with built-in incentives to attract investment. Specifically, businesses are now able to make certain transactions beyond existing FX restrictions, so long as these companies do not breach their investment limit. The limit is equal to how much FX investment a firm can attract from abroad and add to its authorized capital. The greater the investment, the more opportunities for the firm to do business.

Over time, the NBU will move to stage three of easing the FX restrictions. At this stage, the NBU will slowly roll the FX restrictions back to where they were before the full-scale war broke out. The regulator will authorize repayments on all of the loans and investments, while households will be able to conduct more transactions, such as transfers to foreign-issued cards from hryvnia cards. The NBU will also gradually authorize transactions with derivatives, including swap and forward transactions (more on those here), make it possible for foreigners to take out loans, and allow investments abroad.

The order of steps within said stages may undergo changes to help the economy recover and to improve the FX market’s and the financial system’s performance.

When will the further easing of restrictions take place?

The NBU does not set any specific dates for the easing of the restrictions. Any steps in this field will be taken only when the appropriate sustainable preconditions are put in place.

The NBU will take into account the following indicators:

- consumer price growth: inflation should be moderate

- expectations of households, businesses, financial institutions, and analysts about future inflation

- level of international reserves: the NBU must have sufficient reserves to maintain the sustainability of the FX market

- interest rates: bank deposits should ensure protection of household savings from inflation

- financial stability parameters: the banks should remain resilient.

Once all indicators are at required levels, the NBU will continue to ease the FX restrictions. At the same time, the NBU will act gradually and cautiously to maintain the sustainability of the FX market. Before every step, the NBU will analyze whether all the necessary preconditions have been met, and will also estimate the impact on the market from both previously approved and planned easing measures. This will help minimize the likelihood of having to reimpose the restrictions.

What if something goes wrong?

The level of uncertainty fueled by russia’s full-scale armed aggression is still high. If risks intensify, the implementation of the Strategy might be paused and some steps may even be cancelled.

Preserving the sustainability of the FX market will remain one of the NBU’s priorities. This is important for sustainable disinflation and the financial system’s resilience.

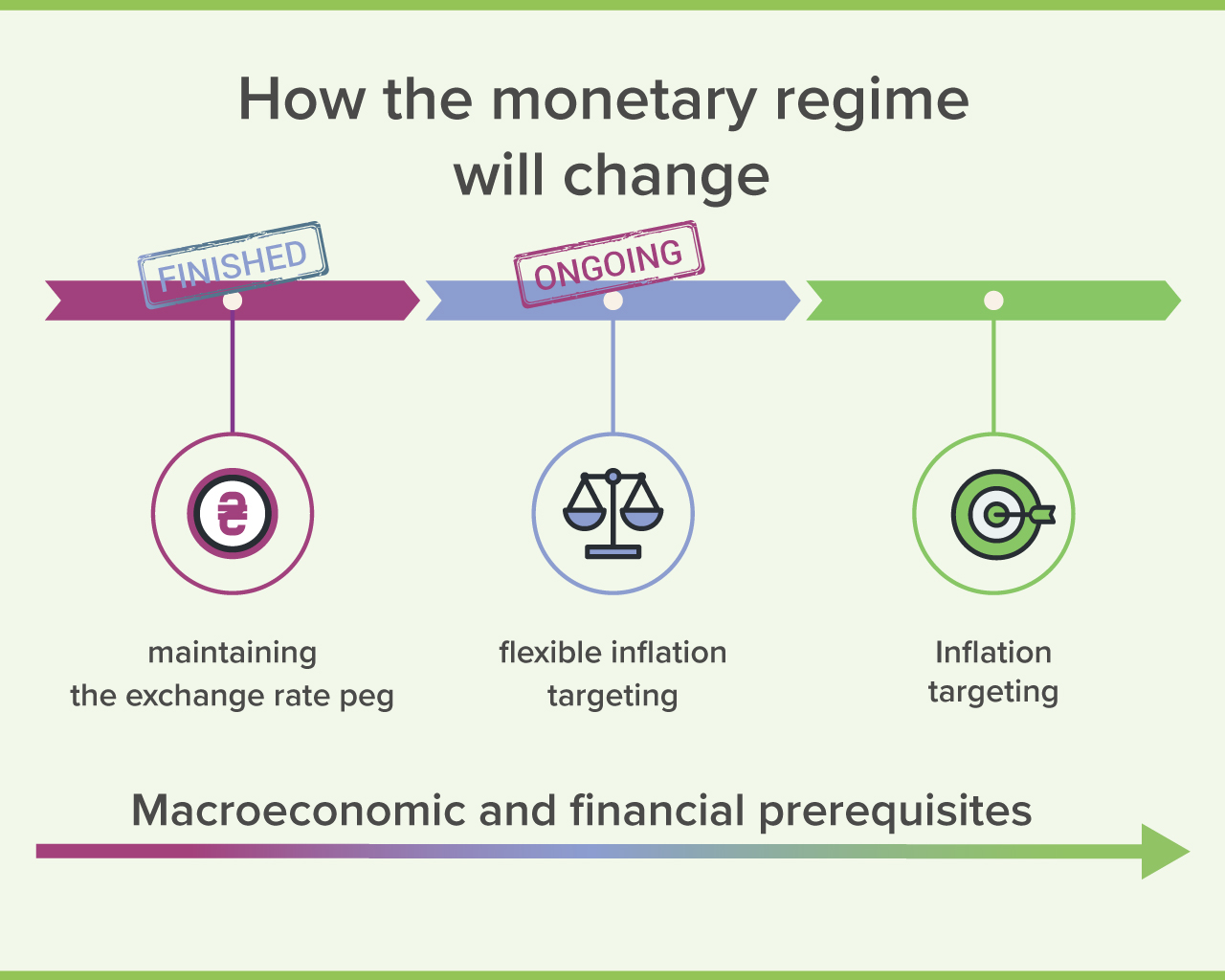

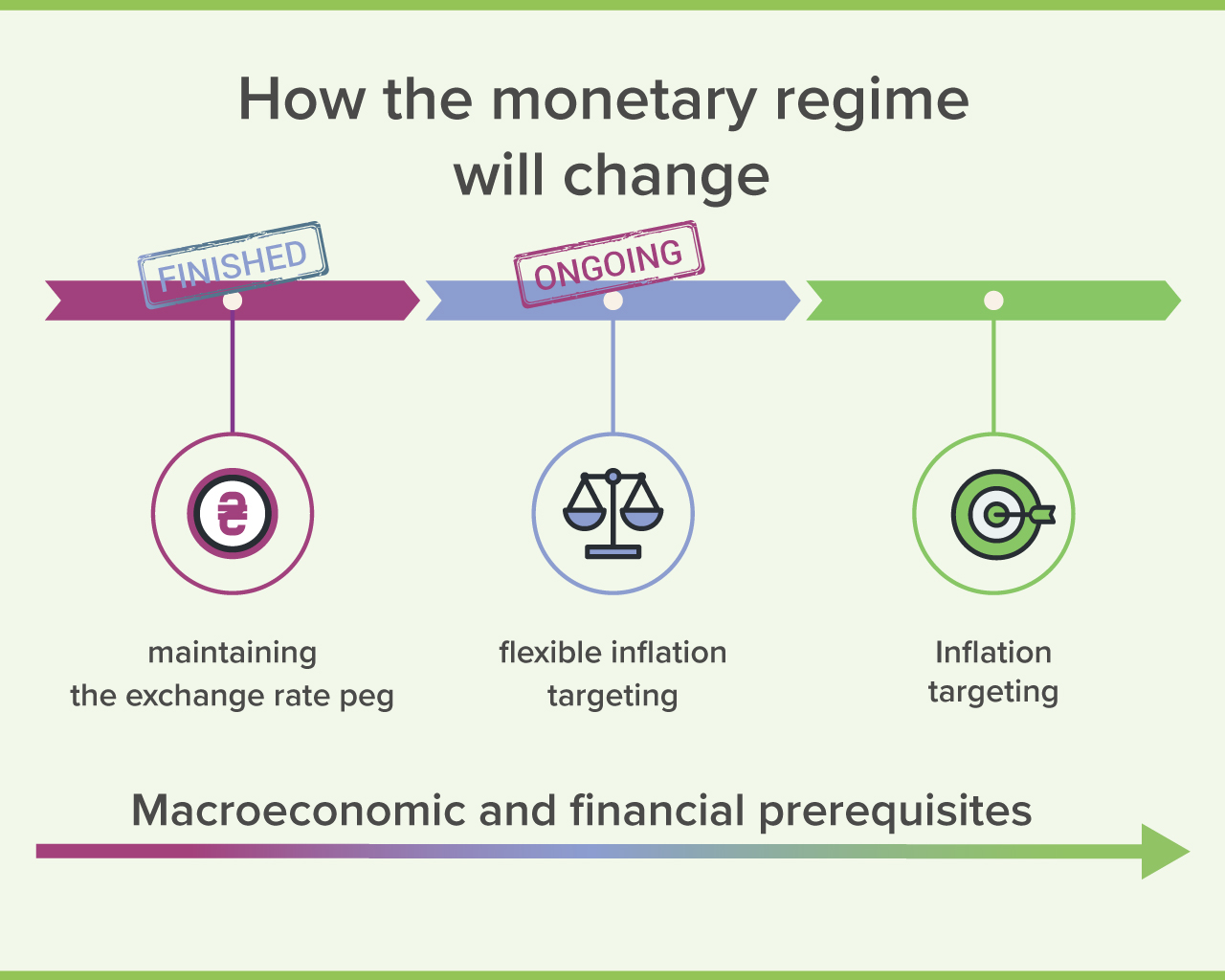

How will the move back to inflation targeting take place?

Returning to inflation targeting with a floating exchange rate – which was in place prior to the full-scale war – is the ultimate goal of the Strategy’s implementation. Such a regime is precisely what will enable the NBU to simultaneously ensure price and financial stability in the long run and to support sustainable economic growth.

The NBU’s return to inflation targeting with a floating exchange rate will also be spaced out in time and will only take place if the prerequisites are met. This is not something that can be achieved in short order.

In the early stages of the Strategy’s implementation, the NBU’s key policy rate will continue to play the role of an auxiliary tool to maintain the sufficient attractiveness of hryvnia assets as a guarantee for the FX market’s sustainability. In other words, the NBU’s policy will continue to be aimed at ensuring that by making hryvnia term deposits, households can protect their savings from losing value. This is important in restraining FX market demand, a condition that in turn will make it possible to maintain exchange rate sustainability and ensure a further decline in inflation.

Going forward, inflation will gradually take over as the anchor of macrofinancial stability, as was the case before the onset of the full-scale war. The key policy rate will regain its status as the main monetary instrument.

Eventually, the NBU will return to the monetary regime it had been operating prior to the full-scale war.

In H1 2024, the NBU successfully returned to a flexible inflation targeting regime. This approach involves the NBU using its policy tools to bring inflation back to the 5% target over the policy horizon, which does not exceed three years.

What will happen to the NBU’s key policy rate during the Strategy’s implementation? How will it affect interest rates on hryvnia retail deposits?

Thanks to the faster-than-anticipated pullback in inflation, the sustainability of the FX market, and record-high international reserves, the NBU had been lowering its key policy rate since July 2023 and up until H2 2024, when the central bank, in response to increased inflationary pressures, halted its cycle of key policy rate cuts and eventually switched to a tightening cycle by raising the rate.

At every stage in the Strategy’s implementation, the NBU has to maintain a level of the key policy rate that allows households to protect their funds from inflation by placing them into hryvnia assets (term deposits and domestic government debt securities). This is important for maintaining the attractiveness of hryvnia savings and reducing the demand for foreign exchange, and thus vital for protecting Ukraine’s international reserves.